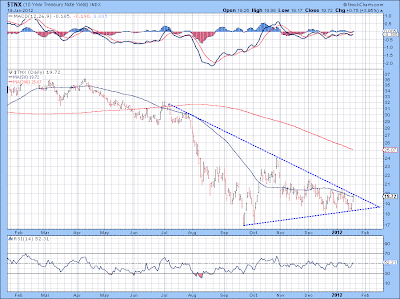

As you can see, the same triangle that formed on the copper chart has formed here. And after today's price action yields are ready to break out to the upside.

For those of you unfamiliar with bond dynamics always remember, as bond prices drop, yields rise.

What this all means is that the "risk on" trade is gaining momentum. As I said this morning, the fix is in! The ECB is pumping European banks with massive liquidity and Euro debt problems are being masked. Mr. Market is happy ... for now. More on this in my weekly newsletter.

No comments:

Post a Comment