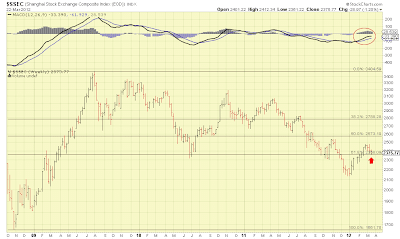

Here's a weekly bar chart of the Shanghai Composite Index:

(click on image for larger view)

The index had turned up at the turn of the year but there's been recent weakness. Momentum (top panel) had been improving but it too is weakening.

There are many crosscurrents in the Chinese political and economic landscape and I believe the country is entering a prolonged period of transition from a largely rural, poor and manufacturing based economy to a consumer based economy. Additionally, the incredible strides in manufacturing technology in the past decade (robotics, etc.) are going to change the manufacturing complexion of the country.

With all that said, China is still on its way to being the world's largest economy and a drop from 12 -13% to 8 - 9% growth is still growth at "break neck" speed.

Doug Kass, in a tweet earlier today, opined that the washout in Chinese stocks may have already occurred. I wouldn't be surprised and I think we'll see demonstrable improvement in the chart over the coming weeks and months.

No comments:

Post a Comment