I want to thank everyone who read Thursday's post. The "hits" on my blog were the highest since I commenced blogging. And what I'm going to do in this weekly commentary is simply to start where I ended on Thursday. If you're following the market you know it's not doing well and so I'm going to identify some key indicators we will need to look to going forward in order to surmise where stocks are going from here.

Here's the New York Stock Exchange Composite Index (NYSE) comprised of more than 1900 US and non US stocks:

(click on chart for larger image)

I've highlighted the 200 day moving average which is used by most professionals as a demarcation line determining whether a market is in bull or bear mode. We've clearly penetrated this line and have pierced the 50% Fibonacci retracement level from highs that were set in 2011.

Here's the Russell 2000 Small Cap Index. The black circle highlights Thursday and Friday's price action. On Friday the index closed below its 200 day moving average. As I've stated before, small caps led this market higher late last year and this weakness also speaks to weakness in the US economy as this index is made up primarily of US companies.

Here's the Dow Transports. It's the same story here with a penetration of the 200 day moving average on Friday. Notice the white arrow. I'm highlighting an almost overlapping of an intermediate and long term Fibonacci retracement level. Where we have close Fibonacci levels like this it has normally provided significant support and/or resistance on any chart where it manifests itself.

Here's the S&P 400 Mid Cap Index which comprises mid-size companies. Here, the index closed virtually sitting on the 200 day moving average.

I won't post the benchmark S&P 500 as it has not violated the 200 day moving average yet closing Friday at 1295.22 (the 200 day moving average is at 1278.22). The NASDAQ Composite is also still above its 200 day moving average.

So, we have small caps, transports and the NYSE Composite confirming a bear market but the Wilshire, Mid Caps, the NASDAQ and S&P still technically in bull mode. Obviously we need to be watching the S&P 500 closely next week. If we manage to close below the 1278 level this market will go a lot lower. A bounce by the Wilshire and Dow Transports off of the Fibonacci clusters I identified above would be constructive for stocks.

Market internals are bearish. Most breadth indicators are at levels not seen since last October. I monitor a variety of indicators after the market closes everyday and the preponderance of evidence points to a bear market coming upon us. A notable exception is the NYSE Short Term Trading Index which is not manifesting the magnitude of bearishness we've seen in prior declines. But it is still giving me a bearish reading. Here's a daily chart of the Percentage of NYSE stocks above their 50 day moving average (only 12.41%):

With fear building again in the global financial market place Treasuries had a record breaking week as investors piled into the safest debt instruments on the planet:

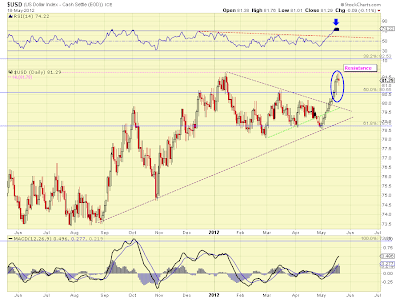

The US Dollar has been a primary reason for stocks problems in the past few weeks. As the Dollar strengthens "risk" assets (stocks, commodities, precious metals) weaken:

As I showed in Thursday's blog post Gold perked up this week. Many attribute the move to the market sensing more central bank liquidity injections (QE) but I attribute the move simply to the "fear trade" and the concerns surrounding parking all assets exclusively in the Dollar. I know this is a minority opinion and I understand the logic behind the QE thesis but I don't see anything emanating out of either the FED or ECB even remotely alluding to more QE. In any case, here's the chart:

Finally, commodities are still manifesting serious weakness.

Here's Brent crude oil and it was being supported for the better part of two weeks by the 61.8% Fibonacci retracement level but succumbed to selling pressure this week and also penetrated a significant support line (yellow dashed line). If you want to understand the strength or lack thereof of the world economy look to oil. And Brent is telling us the global economy is deteriorating.

But let's look at some industrial commodities:

Here's a weekly chart of the PowerShares DB Base Metals ETF (DBB) which is comprised of futures contracts on copper, zinc and aluminum on the London Metals Exchange:

I guess I've painted a pretty bleak picture of the state of the market. But I believe we have some serious impediments to sustained growth in the global economy which I'll be identifying below. My rationale can be supported with hard statistics but I neither have the time nor inclination to add that data to my blog. Anyone can email me and I will be happy to provide links to support my thesis:

1. Greece - I've repeatedly stated that Greece will leave the Euro zone. However, I'm beginning to rethink my position. Latest polls this week show Greek voters backing away from the precipice and a movement back toward the pro-austerity parties. The last polls suggested a "dead heat" between pro austerity parties and the radical left that supports reneging on Greek debt, where as previous polls showed the left in the clear majority. As I reconsider my position I guess if I were a Greek I would seriously ponder leaving the Euro for the reason that, as bad as it presently is, there is no way to predict the impact of leaving the Euro and returning to the Drachma. Analysts and pundits are "all over the board" regarding what Greece's future would be like if they left the EU. Without getting into the details of the possible implications surrounding Greece leaving the Euro, let's assume my original thesis is wrong and they stay in the Euro. Every analyst on Wall Street has calculated it is impossible for them to get out from under the debt that's buried them. The EU would have to relax the austerity measures presently required and extend the maturity on Greek debt significantly. But let's say all that happens. We still have ...

2. Spain - There are big problems here and for an accurate synopsis of their plight I would refer you to Thursday's blog post and the Reuters link on that post. If Spain gets to the point that it cannot bring its debt to market then the Northern periphery (Germany, Finland) will have to be willing support the ECB in printing trillions of Euros in order to buttress Spain. But let's just say the Germans throw all their weight behind a Spanish bailout. Then we'll have problems with ...

3. Italy - no one is talking about Italy because Spain is on the skyline. The bond vigilantes will smell blood if Spain can't sell it's debt in the public marketplace.

4. China - I've been in the "soft landing" camp so far as the Chinese slowdown goes but the April economic data was horrible and there is very little the Chinese government can do, short of outright printing Yuan, to spur immediate growth in their planned economy. And they won't print Yuan since they've been walking a tight rope between keeping inflationary pressures in check and attempting to spur growth. The banks have the money to lend but no one is borrowing! So lowering reserve requirements or interest rate cuts are not having their traditional effect. Fiscal stimulus would take time to run thru the system and so could not have the immediate effect that's needed to arrest the current economic slide.

5. "Operation Twist", the FED's selling short term Treasuries and buying longer term treasuries, ends on June 30th.

6. Bush tax cuts - the market is an excellent predictor of economic conditions six to nine months out. These cuts will lapse starting January 1st, 2013. Although those who point to a 3.8 trillion dollar cut in our debt over the next ten years due to the rescinding of these tax cuts the concern the market has is that raising taxes is never good for an economy as it takes money out of the hands of consumers and puts it into the hands of the government which is not a productive economic entity. Remember, we also have a law on the books that would trigger automatic spending cuts across the government starting in 2013 if congress can't agree to its own spending cuts. And heaven forbid if interest rates start to rise. Because of the global "fear trade" Uncle Sam has been able to finance its debt at bargain basement prices. This can only continue so long.

The government deficit issue will frame the political and economic agenda in this country for the next few years as America confronts its own austerity drama.

In the very short term, Dollar weakness can spur a short covering rally in equities. Stocks are oversold and some of the Fibonacci support I identified above is likely to give us a reprieve from the selling pressure. But, as I stated on Thursday, just because stocks are technically oversold doesn't mean there has to be a bounce. The market is again captive to headlines emanating out of Europe while ignoring the elephant in the room, China!

The Camp David G-8 meetings ended with a lot of positive rhetoric but nothing concrete in terms of actually stopping the unfolding crisis in Europe. The new mantra is growth not austerity. Well, talk is cheap and the Germans are keeping the entire Euro experiment afloat and what they ultimately commit to will be the deciding factor on whether the periphery nations stay in the EU or whether the Euro even survives as a currency. Whether the market takes the meaningless rhetoric out of Camp David this weekend as a positive development is any one's guess. Any bad news out of Europe like this http://soberlook.com/2012/05/run-on-banks-in-spain-is-very-real.html will trump any empty bombast from European politicians.

In the upcoming week leading into the Memorial Day weekend investors and traders will be watching the following economic reports in this country:

Tuesday - existing home sales

Thursday - existing jobless claims & Durable Goods orders

In Europe, I'll be watching some French bond auctions on Monday. I'm not expecting any surprises but in the Euro zone, you never know! :-)

On Wednesday night there's a European Union State dinner and supposedly the meetings at Camp David this past weekend set the stage at this event for serious discussions on a more pro growth agenda for the European Union. We'll see. But on Thursday, there's a spate of data on the German economy that will be closely watched and ECB President Mario Draghi is also scheduled to speak. If the Germans are going to budge off their pro austerity position we should see some movement toward that this week. And the news from Europe coming out of these two days, if substantive, could be constructive for global markets heading into next weekend.

Have a great week!

*** I'm aware that this might not be an historic all time high as there is evidence that Treasuries might have been a tick or two higher in 1942. The problem is that record keeping wasn't what it is today and several sources contradict each other on Treasury prices at that time.

No comments:

Post a Comment