In this commentary we'll be looking at some key support and resistance levels in the S&P 500 as well as a brief overview of the other asset classes. In my Analysis I want to address some of the ongoing fundamental issues which we need to consider if we're going to understand the direction global financial markets in the intermediate term.

(click on chart for larger image)

As can be seen above, the S&P (and all other major indexes) popped their noses above that resistance level immediately after the June EU Summit only to fall back under that line. This resistance area is formidable and will likely need a Bernanke or Chinese boost to get us over. A break out above 1363 will mean a rally to 1375. If we breach 1375 we could run to 1390 or the 1420 level. I'll be skeptical of anything over 1375 given present macro fundamentals.

Here's the Russell 2000 which mimics the chart of the S&P but the Russell has outperformed the S&P over the past month (normally a bullish indication):

The Russell's resistance at the 61.8% Fibonacci retracement level is not as formidable as the S&P's yet, in spite of Friday's powerful rally, it backed off that level by the end of the day.

To sum up, Friday's price action was nothing more than a relief and short covering rally with the catalysts being a better than expected earnings report from JP Morgan and Chinese GDP numbers that were in line with expectations.

Treasuries had another strong week and are closing in on the previous all time highs set at the end of May:

Here's the iShares Barclays 20+ Year Treasury Bond ETF which is used by many as a proxy for the long end of the yield curve. It's been in a trading range since June 1st (parallel purple dashed lines) and there had been even a narrower trading range from June 6th (thin brown line) but this week's price action (blue circle) broke thru that narrow channel. Even with Friday's strong equity rally Treasuries held their own and were only down marginally for the day. Friday's candlestick was a dragonfly doji and is a bullish indicator.

Treasury price action is telling us that stocks are lying. Who do we believe? Always go with the Treasury market. Bonds are smarter than stocks.

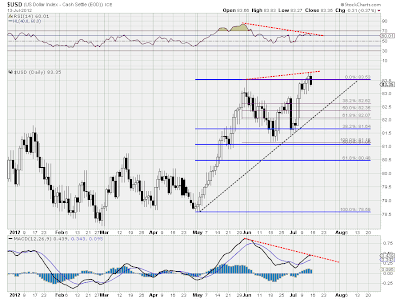

Here's the US Dollar which has had a great run since May 1st:

The Dollar managed to poke through it's May highs but I've outlined a concern I have as we move forward. Notice the red dashed lines on the RSI indicator above and MACD below. While the Dollar has been rallying since early July its momentum is slackening. This is a classic divergence and speaks to imminent weakness in the Dollar in the short term.

Here's the weekly Dollar chart:

This chart looks strong but a doji formed this week which signals indecision. Here's a daily chart of the Euro:

The positive divergences on this chart are directly opposite of the Daily USD chart above.

What does this all mean? Expect a Euro rally up to the 61.8% Fibonacci retracement level on the chart above. This will put pressure on the dollar down to the 82.50 level and possible down to the 81.50 level.

If my thesis on the Dollar/Euro is correct we can expect a rally in stocks very shortly. I expect Treasuries to back off a bit and consolidate before a possible run to new all time highs, courtesy of the "risk off" trade.

Gold has been having a very tough time since it's all time highs last September. My post earlier this week spoke to the deflationary message Gold was sending the market. And although I still believe that there's still a glimmer of hope for Gold and the markets as long as the support level I've delineated on the chart above holds. That level is the $1525 - $1500 level. If we break through that level to the downside it is not only bearish for Gold but for the global economy as well.

Here's the other problem the global economy faces:

The three charts above are meant to give my readers an up to date perspective on the commodity markets. We have Brent North Sea Crude, the Dow Jones UBS Industrial Metals Index and the Shanghai Composite Index.

We have seen some relative strength in commodities as of late. In the CRB Index this has been largely fueled by the incredible rallies in corn, soybeans and wheat due to the severe drought and heat conditions in the mid section of the country. Industrial metals and oil have bounced off their lows in late June and the momentum indicators, especially on the oil chart, have been strengthening. However, the Shanghai Composite, a proxy for Chinese economic strength, is clearly in the doldrums. Without a significant move to the upside in the Shanghai all we can say is that oil and industrial metals are strengthening in anticipation of central bank "hopium" or future liquidity injections.

I'm not trying to have a bearish bias. I've long since disengaged my biases on where I think the markets should go and depend on the charts and fundamentals to tell me how to position myself. But I just can't get excited by the fact that global financial markets continue to depend on central bank intervention to buoy the global economy.

ANALYSIS

As much as I'm tired talking about European debt woes, they are still center stage in determining where these markets are going in the intermediate and long term. To rehash everything that goes on every week over there would be time prohibitive for me and boring to my readers. But let me just give you some salient events/points that we need to consider:

1. The handwriting is on the wall and its clear by the day that the ECB (European Central Bank) must step in to backstop all periphery debt. The Euro is weakening not only on the terrible economic fundamentals of the region but also in anticipation of this eventuality. But will Germany finally relent and approve the backstop? After all, they will be footing the bill. The answer to this question determines the fate of the Eurozone.

2. The pressure on Spain has eased for the moment and recent austerity measures by Rajoy have been seemingly embraced by the market. Nevertheless, the 10 Year bond yield backed up by week's end so this may be only a temporary reprieve.

3. Greece requested an extension on austerity measures in which they have fallen behind schedule and so far the EU (read German) response has been "nein"! I've stated this before but I'll say it again. Greece is a comatose basket case with virtually no hope of digging its way out of the hole it's in. Look for a Greek exit out of the EU sometime in the next year (maybe within six months).

4. There are rumblings in Italy about leaving the Euro zone and there have been a few studies on the street that suggest that this is a real possibility and that it would not be as disruptive to the global financial system as some might suppose?

5. The German Supreme Court is considering whether the ESM is constitutional. The ESM is supposedly the EU's answer to the backstop I alluded to above in point one. Never mind that the money in the ESM would be totally inadequate to support the Spanish and Italian bond markets. I see the court supporting the ESM but anything can happen ...

So nothing has changed in Europe. The situation is extremely deflationary and what the EU needs is time to deleverage periphery debt and to form the fiscal/political union it needs to make its system cohere. And the only thing that will give them that time is the ECB backstopping the entire sovereign and banking system (aka printing money). But will the Germans acquiesce?

The other point I want to make is one that I have addressed before and it seeks to answer the question about how much time might be needed to effectuate a political/fiscal union that can make the European experiment tenable.

There are deep rooted prejudices within the populations of these countries that fuel a mistrust of Germany and are not easily going away. On July 8th, Merkel met Hollande in Reims to celebrate 50 years of reconciliation between the two countries in the aftermath of WWII. The press made much that unknowns had desecrated the graves of 40 German soldiers who had died in WWI in a nearby city immediately before the meeting.

In this week's edition of Barron's Alan Abelson brings up another historical tidbit that also reinforces the tension between EU members based on the sordid history of Europe since the unification of Germany in the 19th Century. I'm quoting directly from Alan's article:

"MONETARY HAWKS ON BOTH sides of the Atlantic are given to pointing to the great Weimar inflation of the early 1920s as a dire warning of what happens when fiscal discipline is heedlessly abandoned. It is now a hoary cliché that the horrors that befell the population from that inflation have been engraved deep in the German psyche, and explain the fear and loathing that nation has for spendthrift policies that have caused Greece to become the poster nation for impecunious fecklessness.

And it's true that taxes are anathema in the cradle of democracy, especially to wealthy Greeks, so many of whom are masters of evasion, something that understandably sticks in the craw of many Germans who are being asked to kick in to help their beset fellow members of the euro zone avoid sliding further into abject poverty under the implacable weight of their towering debt.

Yet the irony of the German complaint, however woefully unappreciated, is tellingly described by Richard Clogg, an emeritus fellow at Oxford, in the July 5 edition of the London Review of Books. He points out that the inflation that racked Germany in the '20s was a mere bagatelle compared with the inflation visited on Greece as a result of the April 1941 invasion by the Germans, aided and abetted by Italy and Bulgaria.

The tripartite occupation, Clogg states, "set in train one of the most virulent hyperinflations ever recorded, 5,000 times more severe" than that suffered by Germany. Price levels in Greece in January 1946 were—are you sitting down?—more than five trillion—yes, trillion—times those of May 1941. Yet somehow, when the talk turns to inflation, you don't hear a peep about the almost unimaginable effects of the German occupation of Greece.

Beyond the economic damage, as many as 200,000 starved to death between 1941 and 1943 in the famine that was one of the direct consequences of that occupation. The Wehrmacht and Waffen-SS slaughtered and tortured at will and vengefully pursued a scorched-earth policy when they pulled out in 1944, leaving in their bloody wake 1.2 million Greeks homeless and 5,000 schools wrecked.

Clogg comments that "few would insist that the iniquity of the fathers should be visited on the children." And he grants that "postwar Germany has made impressive efforts to exorcise the demons of its recent past."

But he insists that the bitterness, indignation, and frustration exhibited by the Greeks at being scolded by the Germans about their grievous financial shortcomings "should be understood in the context of some of the worst atrocities committed by the Wehrmacht anywhere in occupied Europe."

My point should be obvious from both episodes. I don't deny the will of European leaders in making the Euro experiment a success but how long will it take to bury the prejudices that have developed due to history? Heck, some people are still fighting the Civil War in this country!

The market ultimately believes that the Europeans will relent and print money to buy time. I'm ambivalent. In any case, the points outlined above will weigh on our markets until they are resolved in either a deflationary or inflationary way.

China's GDP came in at expectations but I wouldn't be surprised if they were lying. The predominant view from pundits and research analysts is that we will see an upturn in the Chinese economy in the second half of this year. Again, until we start seeing commodities and the Shanghai moving higher this is only speculation. No one really knows what's going on in China.

To sum up, there are technical indications that we could see a rally in risk assets and depending on "hopium" dispensed by central banks that rally could last awhile. However, any reverberations from Europe will put the "kibosh" on any upside. We've been and will continue to be captive to news events emanating primarily from Europe and to a much lesser extent, China.

News events that will move markets this week:

Monday - Retail Sales @ 8:30AM EST - look for a positive report. Anything better than expectations will add more fuel to Friday's rally.

Empire State Manufacturing Index @ 8:30AM EST - ditto retail sales above.

Citigroup's 2nd Qtr earnings report will be scrutinized by market participants who are looking for more strength in the banking sector after JP Morgan's and Wells Fargo's strong earnings reports on Friday.

Tuesday - Industrial Production @ 9:15AM EST

German ZEW Economic Sentiment - could be a big mover if it reflects a big change either way from the previous month. Indications are that it may be flat.

Ben Bernanke speaks to Congress starting at 10 AM. All market participants will be dissecting anything he says searching for "hopium". I'm not expecting any new revelations from the FED Chairman.

Thursday - Jobless claims @ 8:30AM

Existing Home Sales @ 10AM EST

Philadelphia FED Survey @ 10 AM

All industrial reports (Industrial Production, Empire State Manufacturing and especially the Philadelphia FED Survey) will be market movers this week as the street looks for confirmation (or non confirmation) on the spate of weak economic reports we've recently seen.

Have a great week!

PS. As of the time of the release of this commentary there has been no news out of China on the supposed stimulus package making the rounds on the street. This may lend some credibility that the GDP numbers were genuine.

NOTHING IN THIS COMMENTARY SHOULD BE CONSTRUED AS AN OFFER OR ADVICE TO BUY OR SELL ANY SECURITIES, OPTIONS, FUTURES OR COMMODITIES. THE OPINIONS ARTICULATED ARE ONLY THIS AUTHOR'S WHO IS NOT A REGISTERED INVESTMENT ADVISOR OR BROKER.

No comments:

Post a Comment