(click on chart for larger image)

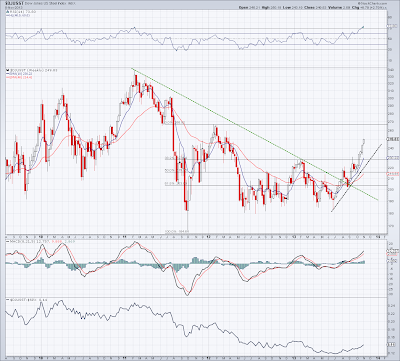

The S&P 500 finished the week up 0.51%:

(click on chart for larger image)

Notice the momentum indicators in the top panels in both above the charts. They've penetrated a down trend line which augers well for future momentum.

Friday's rally stopped any correction that may have been brewing in its tracks. What was interesting was that the market took the strong employment report as a positive for equities instead of negatively reacting to the possibility that the Fed would consider taking away the punch bowl sooner rather than later. The "good is bad and bad is good" paradigm which we have repeatedly seen over the past five years did not hold true this time.

The monthly employment report showed 204,000 jobs were created in the month, while the unemployment rate came in at 7.3 percent in line with estimates. Economists had expected only 120,000 new jobs in October. When the report was released I responded with a laugh! It seemed incomprehensible that with the government shutdown and the inevitable skewing of the data from that event that such a large variance from the previous reports could be possible. Mark Zandi, chief economist with Standard and Poors described the report as "bizarre" to which I wholeheartedly agree. Nevertheless, the market reacted as it always does to reports that defy expectations and, in this case, ignored the prospect of Fed imminent tapering and the rally started, erasing many of the losses incurred on Thursday.

Almost immediately, market pundits started speculating that maybe the economy was much stronger than many thought. Equities ignored the consumer confidence numbers about an hour later that came in lower than expectations.

A lot of emotion was spent by the wild swing we had between Thursday and Friday. Folks went from abject despondency when price action broke down on Thursday after an initially strong open to extreme euphoria on Friday regarding the economy and all the other ancillary issues that are connected to the present market environment we find ourselves. If you follow the financial media you might have felt like you were on a roller coaster; one day seemingly facing a meaningful market decline; the next day speculating on a new "golden age" for the economy and stocks. When these situations arise I find it's best to put all the emotion aside and just analyze the technical condition of all asset classes in order to cut through all the "noise" and determine whether anything meaningful has changed in the market and global economy. And that's what I intend to do for the rest of this commentary.

The reaction to the employment report immediately impacted Treasuries and they sold off. Remember, when bond prices drop yields rise. Here's a weekly chart of the Ten Year Treasury yield:

(click on chart for larger image)

The yield on the Ten Year spiked during Friday's session to 2.75%. This surge in yield was immediately felt in the home building stocks as the historical relationship over the past five years is that an increase in rates will have a proportionate effect on mortgage rates and home buying:

(click on chart for larger image)

The chart above is a daily chart of the iShares Dow Jones US Homebuilding ETF (ITB). Notice the bottom panel. Home building stocks have been under performing the broader market since May when rates started moving higher. The relationship between interest rates and home building has a huge impact on economic growth and so this relationship is a potential "canary in the coal mine" for the Fed. It will be one of the most important charts in gauging US economic strength over the next year. If home building stocks can shake off the specter of rising interest rates and move higher it will truly be the signal that our economy and financial markets can stand alone without the Fed "training wheels".

Regardless of any optimism that our economy is in full recovery mode, the message from commodities is still mixed. Steel has been rallying for some weeks now and that strength continued this week. Here's a weekly chart of the Dow Jones US Steel Index:

(click on chart for larger image)

However, base industrial metals are still stuck in the doldrums as reflected in this weekly chart of the Dow Jones-UBS Industrial Metals Index:

(click on chart for larger image)

An interesting development took place this week that highlights the true weakness behind industrial commodity prices over the past five years. The LME ( London Metal Exchange) approved changes to its warehousing policy which should ease some of the bottlenecks that have developed since the Great Financial Crisis in base metals like aluminum. Warehouse bottlenecks materialized at LME-registered warehouses after metals like aluminum became a financing tool in the wake of the global financial crisis. Producers sold or pledged metal to traders and banks to raise much-needed working capital, with the result that the aluminum was locked up in warehouses. This obviously created pricing pressures in all base metals. Now, with this impediment out of the way, already depressed prices may slide even more. Here's a weekly chart of the iPath Dow Jones AIG Aluminum Sub Index (JJU):

(click on chart for larger image)

It's apparent that the news that aluminum is more readily accessible to producers is having a negative impact on the price. This is reflective of the incredible slack in the global economy.

A positive development for US consumption can be seen in the price of oil. Brent crude is moving lower as US fracking production is contributing to global oversupply. This, in turn, is allowing "main street" more flexibility for discretionary spending. Here's a daily chart of Brent crude oil:

(click on chart for larger image)

I bought gas on Monday, 11/4, in New Braunfels, Texas for $2.83/gallon! Look out for more lower prices. This could be a game changer for consumer confidence and consumption in the months ahead.

Of course, a stronger US Dollar is also adding impetus to oil's move lower. USD has been on a tear for two weeks and received an added boost when ECB President Mario Draghi announced a .25% cut in the short term EU interest rates, thereby weakening the Euro which is 57% of the US Dollar index:

(click on chart for larger image)

The US Dollar has rallied up to Fibonacci resistance and attempted to penetrate it on Thursday and Friday to no avail (notice the long wicks above the candlestick bodies). Any further weakening of oil prices will be facilitated by a penetration of this level by the Dollar. Of course, based on prevailing inter market relationships, a strengthening Dollar may also be signalling that there are other issues brewing in the global economy that are not necessarily positive for global growth.

Gold took a drubbing this week because of the rallying dollar which calls into question the thesis that things are suddenly getting better. Aside from the fact that the inverse correlation between the Dollar and gold need not be consistent on a daily basis, if there is genuine economic growth, both here in this country and globally, then why wouldn't the main predictor of inflationary expectations be moving higher? After all, as been stated in past commentaries so many times and generally speaking, inflationary pressures are a necessary result of improving economic conditions in a fiat currency system. Here's a daily chart of the SPDR Gold Trust Shares (GLD):

(click on chart for larger image)

Gold bounced off of Fibonacci support on Friday after trading in a relatively tight range all week. I still believe, as stated here, that Gold, unless it violates the $1,200.00 level, has seen its worst days. If I'm wrong and we do penetrate the $1,200.00 level then even I, who has been the "town crier" for deflation, has under estimated the strength of global deflationary forces at work and we're in real trouble!

At this point I think it would be a good idea to see how China is doing. Here's a daily chart of the Shanghai Composite Index:

(click on chart for larger image)

The Shanghai has failed to hold above a key level on the daily chart and appears to be breaking down. The Shanghai seems to be giving us a different signal than the steel chart above which has been highly correlated with Chinese manufacturing activity in the past.

Analysis

There was considerable excitement on the street on Friday that the prospect of imminent Fed tapering in light of the latest monthly jobs report had no significant impact on the rally. Market pundits took this as a signal that we may well be "out of the woods" and that the economy need not be concerned about future Fed liquidity. Many are starting to say that "tapering" has now been discounted by the market. I am not sure.

To me, the price action among home builders since May has been disturbing. With the rate on the Ten Year Note only at 2.75% and mortgage rates at an average of 4.16% as of Friday's close, how strong can the consumer and consumption be when home builders move lower with every basis point increase in rates?

Additionally, while we can all applaud the discounts we are now receiving at the gas pump it must be realized that, in spite of the new supply coming to global markets courtesy of US fracking technology, slack demand has as much to do with the drop in gas prices as over supply.

Yes, US manufacturing is looking up but we've seen this movie before over the past five years. I also was concerned that consumer confidence dropped in early November with the lower gas prices we are all experiencing but I also have to say that I don't hold a lot of confidence in statistics generated from telephone surveys.

The ECB responded with a surprise interest rate cut on Thursday, lowering the interest rate it lends to banks at its normal facilities to 0.25% from 0.50%. It also reduced the rate for its overnight loans to banks by the same amount and offered unlimited loans to banks out to 2015.

Many on the street lauded Draghi's move as much needed (and it was) but underneath it is not seen as enough to stem the deflationary tide that seems to be overtaking the EU. Marc Chandler, Chief Currency Strategist at Brown Brothers Harriman and arguably one of the brightest minds on the street believes the latest move by the ECB will be ineffective. He argues here that what is needed is OMT (Outright Monetary Transactions) but the political impediments to implementing such a policy are possibly insurmountable. It's those "pesky" Germans that stand in the way! One way to loosen monetary conditions would be to lower required reserves banks have to carry coupled with a refi rate cut. In the absence of that, deflationary pressures in the EU are liable to persist.

In our country, with inflation running at an annual rate of 1.2%, there appears to be no signs of any inflationary pressures at this point in time. Here's the latest update of the Velocity of M2 Money Supply provided by the St. Louis Federal Reserve:

(click on chart for larger image)

Additionally, the PCE (Personal Consumption Expenditures) Deflator which measures the average increase in price for all personal consumption in this country is abysmally low:

(click on chart for larger image)

chart courtesy of www.barchart.com

I know I'm sounding like a "broken record" to many of my regular readers but these two charts are indicative of an economy still limping along and not one of an economy shedding it's contractionary shackles and growing.

What's the primary difference between the situation in the Euro zone and the US? The ECB cannot, by legal mandate, pump unsterilized money into their system, meaning where they add liquidity somewhere they need to take it out of the system elsewhere. But we here in this country have been pumping unsterilized liquidity into our system since 2008! And as a result, our inflation rate only betters the EU by 1/2 of a percent!

So, the market's seemingly positive reaction to yesterday's jobs report (which will most certainly be revised) and it's apparent lack of concern that such a report could hasten Fed "tapering" was a singular "one off" event, not liable to be repeated.

I've made three predictions over the past month that I'm reiterating here:

- S&P 500 at 1860 by year end

- no Fed tapering until at least March, 2014 (if then)

- Gold, depending on Fed largesse, may have seen it's bottom

I'll be right about gold if we do see inflation pick up. I must admit that I was disappointed with the latest Velocity of M2 data as I had detected a flattening of the downward trajectory in previous reports. Gold's key level remains $1,200.00. If it pierces that level we have real problems and the Fed may never take away the punch bowl anytime in the future. And if they do so anyway they will only exacerbate the disinflationary decline into outright deflation.

Looking at next five trading days, we have a light economic calendar and Friday's move higher has provided the momentum for a positive week. I'm looking for a resumption of the slow, steady grind higher.

Have a great week!

No comments:

Post a Comment