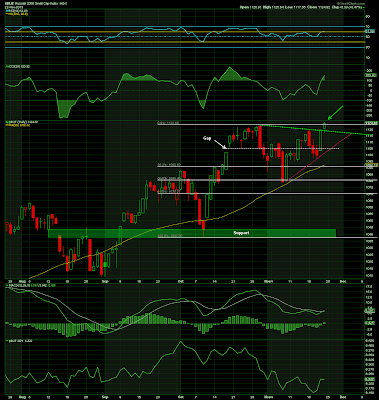

Here's a daily chart of the Russell 2000:

(click on chart for larger image)

It appears that small caps are resuming their leadership and their performance this week was incredible! When more speculative stocks are responding like this it is a very good sign for the market going forward.

The Dow cracked the 16,000 mark this week as the S&P broke through the 1800 level. Here's a weekly chart of the Dow Jones Industrials from the March, 2009 bottom:

(click on chart for larger image)

Here's a daily chart of the S&P 500:

(click on chart for larger image)

Notice the bottom panel under the price action. The MACD (Moving Average Convergence-Divergence) is flattening out which is indicative of a stock market that is slowly grinding higher. This is the "melt up".

Overall, breadth indicators are positive and depending on how you want to read them you can come away bullish or with some reservation on the market's inner strength. But we must all understand that the main driver for equities, either directly or indirectly, is central bank liquidity. Directly, money is finding its way into the market through the Fed and it's dealers. Indirectly, individual investors are starting to capitulate and funds are starting to move into the market from those who cannot find yield anywhere else and don't want to miss the ride higher. There seems to be no catalyst that can stop this market from steamrolling higher.

Treasuries are settling down and actually had a modestly positive week as it is starting to sink in with market participants that the Fed isn't tapering anytime soon and that when the tapering finally comes it will be with added "forward guidance" tools in the form of a possible lower threshold target for the unemployment rate to 5.5% and continued "jawboning" about anchoring the short end of the yield curve by keeping the Fed Funds rate at 0 for years to come. Indeed, as the Fed methodically repeats this mantra through Fed governor speeches the market may end up taking the tapering when it comes, in stride. Here's a weekly chart of the Ten Year Treasury yield :

(click on chart for larger image)

What's noteworthy about the chart is that the Ten Year yield has not been able to decisively penetrate a long term resistance line going back to June 2007. Until it does no one can state that the epic thirty year bull market in bonds is over. Sure, we've seen the lows in interest rates; for some of us, in our lifetimes. But until that resistance line is penetrated we can be comfortable with the notion that long term interest rates will stay low for some time to come.

A stable low interest rate environment is bullish for stocks in any market environment as investors will move into equities in search of the yield they cannot get in interest bearing instruments. So much more in our present environment where interest rates are at historic lows not seen since the depths of the Second World War.

Gold declined again this week and we're moving closer to that "make or break" $1,200.00 level that the yellow metal must hold. Here's a weekly chart of the precious metal with key support and resistance levels:

(click on chart for larger image)

Regular readers of my commentary know the importance I've attached to gold not only as a prime inflationary indicator but as a leading deflationary indicator. A break below $1,200.00 will be a signal that deflationary forces are building momentum and a penetration of the $1,100.00 level will serve as correlating proof that those forces have a stranglehold on the global economy.

Commodities are still flat with only the slightest positive movement in spite of avalanches of liquidity emanating from the Fed and the BoJ (Bank of Japan). Here's a daily chart of the S&P GSCI Industrial Metals Index:

(click on chart for larger image)

A case can be made that industrial metals are building a base and I would not take a position against that thesis. However, until industrial metals decisively break out above the black dashed resistance line on the chart above all we can say is that they are going nowhere.

Finally, I'm going to post a chart of the Japanese Yen which has been inversely correlated with global equities:

(click on chart for larger image)

As the Yen rolls over again this recent inter market relationship continues to provide a tailwind for global stocks and especially US equities in the short term.

Analysis

Just this week I received a call from a client asking, "when is the correction coming?" These type of concerns from the general public are NOT indicative of a market top. When I start getting calls asking, "How high are we going?" then I'll start worrying about a top.

On a short term basis the AAII Sentiment Index, which measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market for the next six months has evened out and is no longer lopsided toward a bullish persuasion which, as a contrarian indicator, is good for the market going into year end.

The ten day moving average of the ISE Sentiment Index, which measures opening long customer transactions to calculate bullish/bearish market direction is the highest it has been this year and although I haven't researched it may be the highest it's ever been. I have followed this sentiment indicator for a few years and generally speaking, a high reading has been predictive of rising equities. So this is giving us a very bullish signal moving into year end.

The only "bump" I see in the road in the short term is the monthly employment report due to be released on the first Friday in December. With all the worries that the Fed may start tapering after their December meeting, a strong non farm payrolls number may spook the markets and we may see some volatility. And, of course, the actual meeting and it's announcement on December 17th will be closely watched by market participants.

I am still very confident that with the dangerously low inflation rate in this country, regardless of how strong the employment report may be, the Fed will wait until their March meeting to start tapering. There are other reasons they will not move this year that I've addressed in a previous commentary.

In the meantime, enjoy the melt up! Bad news remains good news and good news seems to mean good news also. This is still the bull market everyone loves to hate! And for that reason this bull still has room to run ...

There will be no commentary next week. Happy Thanksgiving!

No comments:

Post a Comment