(click on chart for larger image)

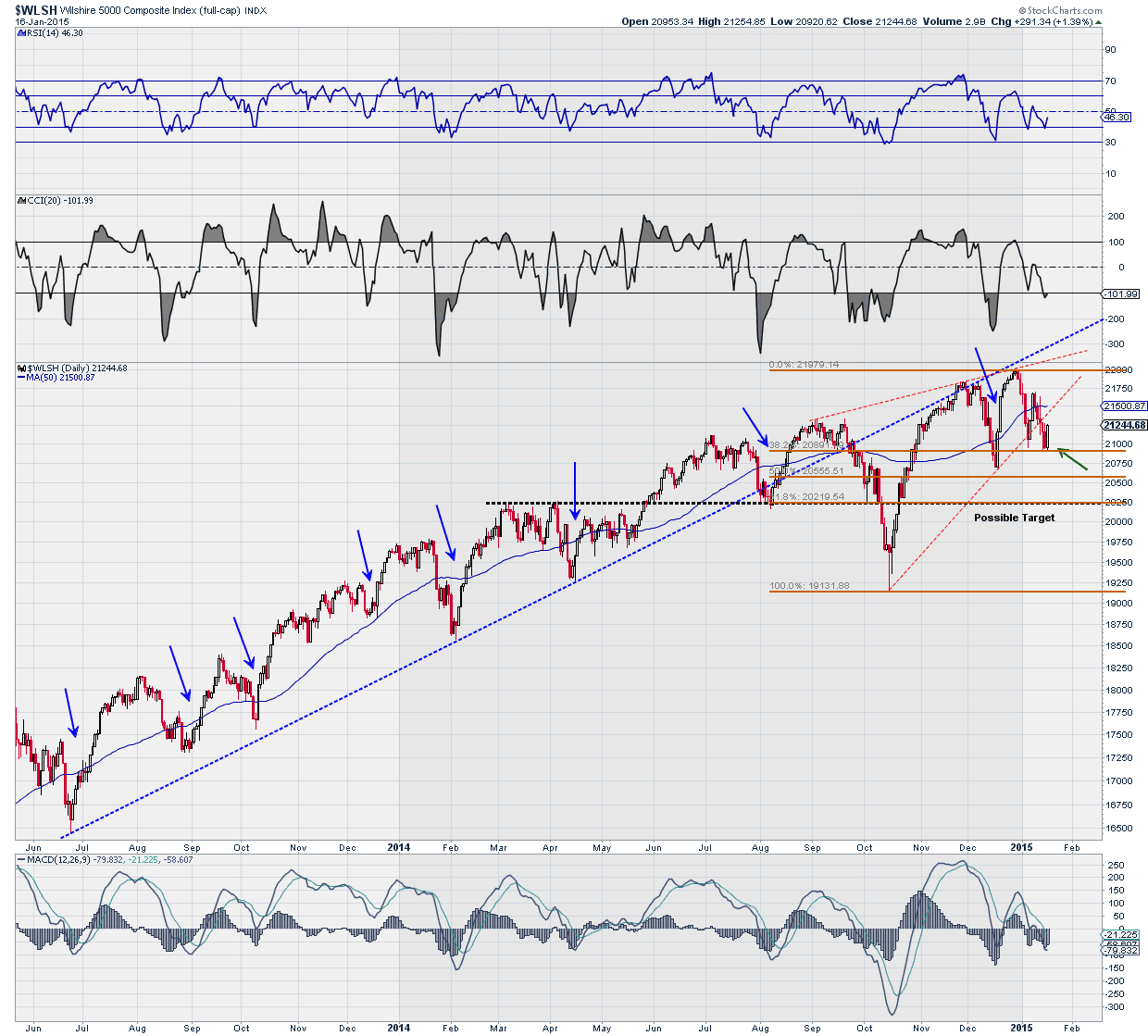

As noted in the previous commentary, the "ascending triangle" (red dashed lines) was violated this week and I've targeted the the 20225 area for support. However, with Friday's price action a bullish candlestick pattern (a bullish engulfing pattern) has formed and I believe we are going to get a bounce from here. My confidence in this call is supported by the price action which reversed right on a Fibonacci support line (love those Fibonacci lines!). And, as we see the previous corrective patterns on the chart (blue arrows), leaving the October correction aside, the recent weakness can be seen as a "garden variety" pullback. It's always good to step back and "see the forest for the trees", especially with all the gut wrenching volatility we've experienced in the past few weeks.

Another reason why I believe the short term trend is now positive is because it appears that with Wednesday's surge in crude prices, oil may be consolidating at these levels. Here's a daily chart of West Texas Crude with the S&P500 below. I highlighted the point when the sell off in crude accelerated (red vertical line) and have lined the two charts up with a correlation coefficient in the bottom panel:

(click on chart for larger image)

The chart serves to show the strong correlation between the price of oil and equities over the past month. The correlation is really no surprise as any market watcher could glean this but it also tends to validate my thesis that to the extent oil consolidates, equities will stabilize and move higher.

Is the sell off in oil over? A lot of people are hoping but I'm not so sure. The geopolitical and economic fundamentals driven primarily by the Saudis tell me it is not. The Saudis can drive the price down to $20/barrel before it is unprofitable for them to pull it out of the ground. However, fiscally they need $77/barrel to maintain their economic and social programs in the country. They have already warned their population to tighten their belts. The Saudis are on a mission and are accomplishing two objectives simultaneously. They are hurting their enemies in that area of the world (Iran & Russia) and they are protecting their "swing producer" status be breaking the back of highly leveraged "frackers" in the US. And I don't believe their objective has been met yet. Another technical reason why I believe we will still see lower prices is the following chart:

(click on chart for larger image)

This is a weekly chart showing the spread between the price of Brent Crude and West Texas Crude. Historically, Brent has sold at a premium to West Texas over the past five years at $10/barrel. That spread is now less than $4.00. Without getting into details that some of my readers might not understand, the spread is a reflection of the supply in the market and with Brent so low as compared to West Texas, buyers are just as willing to buy Brent that's sitting offshore in oil tankers in the Gulf of Mexico as to buy it from domestic suppliers. This over hang of supply is not a good harbinger for the future price stability of "black gold".

With the short term trend higher there are still major challenges brewing this year which will have a profound effect on stocks.

Certainly, the message of Treasuries is that we are in the midst of a weakening global economy. Yields in this country are dropping like a rock since the new year began and although we've had some tepid economic numbers in this country over the past few weeks, with international economic challenges growing money is continuing to flow into the safe haven of Uncle Sam's debt, pushing Treasuries higher (with lower yields) and strengthening the US Dollar. Here's a seven year daily chart of the Ten Year US Treasury Yield. I've highlighted a few historical points to give my readers some perspective on where we're at:

(click on chart for larger image)

Here's an updated version of the US Dollar chart I posted two weeks ago:

(click on chart for larger image)

What's significant about the Dollar chart above is that it is a monthly chart. Moreover, the Dollar is cutting through multi year resistance like a hot knife through butter. Now, the month is not over and I suspect we may see some Dollar weakness going into a very eventful upcoming week (more on this below). Admittedly, in a technical sense I don't have much to hang my hat on in this regard but I sense there's going to be a lot of positioning in the currency market prior to the European Central Bank's upcoming meeting this Thursday, January 22nd. Here's the daily chart of the US Dollar and I circled the price action over the last week and a half:

(click on chart for larger image)

The price action reflected in the individual candlesticks speak to a slow down in the currency's steep rise. Ideally, I'd like to have other technical indicators corroborating my thesis but there is none to be found. So I may very well be wrong. We'll see ...

Speaking of currencies, the FOREX (foreign exchange) market was thrown into turmoil on Thursday when the Swiss National Bank decided to ditch a cornerstone of their monetary policy: "pegging the Euro" (1.20 Swiss Francs to one Euro). As the Swiss Franc soared and the chaos subsided, the surprise move shuttered a firm in New Zealand and FXCM, the largest retail currency trading firm had to scramble to seek emergency funding when $225 million in it's clients margin calls could not be met. Leucadia National finally threw them a $300 million lifeline so they could stay open. But the big winner in all this was:

(click on chart for larger image)

Gold had been consolidating and most traders thought it might be just a rest before another leg lower. And they still might very well be right. However, with the Swiss Franc now free floating against the Euro the safe haven status of the Swiss Franc is reaffirmed and the world's truly hard currency, gold, has broken out of a multi month downtrend as seen on the chart above of the SPDR Gold Trust Shares ETF (GLD), the popular trading vehicle for those traders/investors who do not want to trade the metal directly in the commodity market.

It will be important to monitor the price of gold here. This could be a false breakout. I'm not saying this because I have any antipathy towards gold. Some dear friends of mine (both here and departed) are "gold bugs". But soaring gold and a surging Dollar are not correlative in a deflationary environment which we find ourselves. True, gold fared well with a strong Dollar in the 1930's however, at that time the US government had pegged it's price at $35/ounce and it manifested it's strength through gold mining companies that traded at that time. We'll see where we go from here.

Finally, let's take a look at Emerging Markets. Here's a daily chart of the iShares MSCI Emerging Market ETF (EEM):

(click on chart for larger image)

EEM has been flirting with gap resistance for a number of weeks and because of this, I'm of the opinion that we will see a breakthrough here. Now, this thesis is incompatible with other inter market relationships that seem prevalent in the market but as I stated in my last commentary, traditional inter market relationships have been inconsistent recently. For a student of inter market relationships, it's sort of like flying blind. EEM's price action does not make sense to me in a deflationary world where the exporting economies of Asia and South America depend on the consumption of the developed countries of the West. So, a break out here would be very constructive for the global economic picture and if EEM is decisively turned away here it would reaffirm the deflationary stranglehold that appears to be taking over the planet.

ANALYSIS

The major event that will have an impact on stocks for at least the first half of this year is the upcoming ECB meeting on January 22nd. It is widely expected that the outcome of the meeting will be a significant policy change so that policymakers can stave off the deflationary spiral that is threatening the Euro zone. But deflation is already there:

(click on chart for larger image)

This is hardly the "shock and awe" that accompanied both the US and Japanese QE efforts. And there in lies the concerns market participants are starting to have and has been, in my opinion, an attendant reason for the market volatility the past few weeks.

First of all, there's a possible chance that there will be no announcement on Thursday, the 22nd. ECB President Mario Draghi made that clear in his last press conference. The announcement could come in June. But the chart above speaks for itself and, like inflation, waiting will only exacerbate the deflationary spiral. Many are arguing that it may already be too late to stem the tide.

Secondly, there is the important argument surrounding how effective sovereign bond purchases would be. Yields are already so low that the benefits in attempting to push them lower may not be worth it and may create other significant distortions that make the effort dangerous. After all, if the ECB buys the debt, who holds it? This is an ongoing debate in the ECB governing council and rumors persist that while the ECB will implement the policy the national banks will hold the debt. But in a deflationary environment national banks take on a dangerous exposure if the bond buying does not accomplish the goal of reflation. And then there's always the moral risk associated with these purchases which is behind the Germans main objection to this proposal.

Behind the German concerns and a huge part of the problem is the quiet recognition in the Euro area that monetary policy can only go so far in "kick starting" a recessionary economy and that fiscal policy must take over. But there is no will in the Euro zone, either among the Italians, French or the Germans to confront this issue. I cite in defense of this position the recent submission of France's national budget to the EU which was over the mandatory 3% deficit threshold. The result is that they went into "negotiations" with the EU on this budget and the whole issue was essentially glossed over.

I understand that issues are much more complex than stated above but these events underline the deeply flawed concept behind the EMU (European Monetary Union). Monetary union without fiscal/political union is untenable.

And so the Germans, which are the deep pockets over there, don't want to get caught holding the bag. And they have significant political sway in the ECB although they can be overruled.

So, whatever is announced on Thursday (if it is announced) is more likely to disappoint the market than to encourage it. Certainly a "shock and awe" surprise would be met with frenzied buying in the equity markets but no rational person can expect this outcome.

It's difficult to speculate the market reaction, especially with the focus on the price of oil (another deflationary beacon notwithstanding arguments that it's about oversupply). But I now believe the best outcome will be for the market to take the announcement in stride unless they postpone their decision.

If they postpone the decision things will probably get ugly. If they come in with $500 billion in sovereign purchases we're liable to see a rally but not of the magnitude I previously had predicted. After all, as stated above, they're at the point where they are confronting diminishing returns unless they go "all out"; buying anything and everything they can in the bond and debt markets. And for reasons stated above, they will not do that.

However, the market is wiser than any individual or entity engaged in it and anything can happen. The fact that inter market relationships are getting tricky and that emerging markets have been resilient in the face of significant volatility is encouraging to me.

There are also issues going on in Greece that I'm not too concerned with at this time but which must be watched. And it is becoming more apparent that the Fed's anticipated interest rate increases will be postponed until later in the year? Remember "Liquidity Traps Revisited"? I'll be addressing these issues in my next commentary in two weeks.

Have a great week!

The statements, opinions and projections made in this writing are for informational purposes and are my own. They do not represent the views of my broker/dealer. Additionally, this writing does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction, or as an offer to provide advisory or other services by me or my broker/dealer in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction.

The information contained in this writing should not be construed as financial or investment advice on any subject matter. This writing is not published for the purpose of utilizing the information for short term trading or long term investing in stocks, bonds, ETFs, mutual funds,currencies, indexes, index or stock options, LEAPS, and stock or commodity futures. I expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing. Seek the personal, face to face guidance of a registered investment advisor before entering any trade or investment. Anyone who trades or invests based on the information in this commentary does so at his/her own risk.

Warning! you can lose some or all of your principal (money) investing in stocks, bonds, ETFs, mutual funds, currencies, indexes, index or stock options, LEAPS and stock or commodity futures!

No comments:

Post a Comment